Start Your Stress-Free Investment Journey and Live the Life You Love

With AlphaaMoney’s Professional

Investment Strategies

Diversified Portfolios

Tailored Solutions for

Every Financial Goal

Managed by Expert

Fund Managers

Tailored Investment Strategies for Every Investor

Expert PMS for Confident

and Peaceful Investing

Tailored Mutual Fund Portfolios

for Optimal Growth

Automated ETF Portfolios

for Effortless Growth

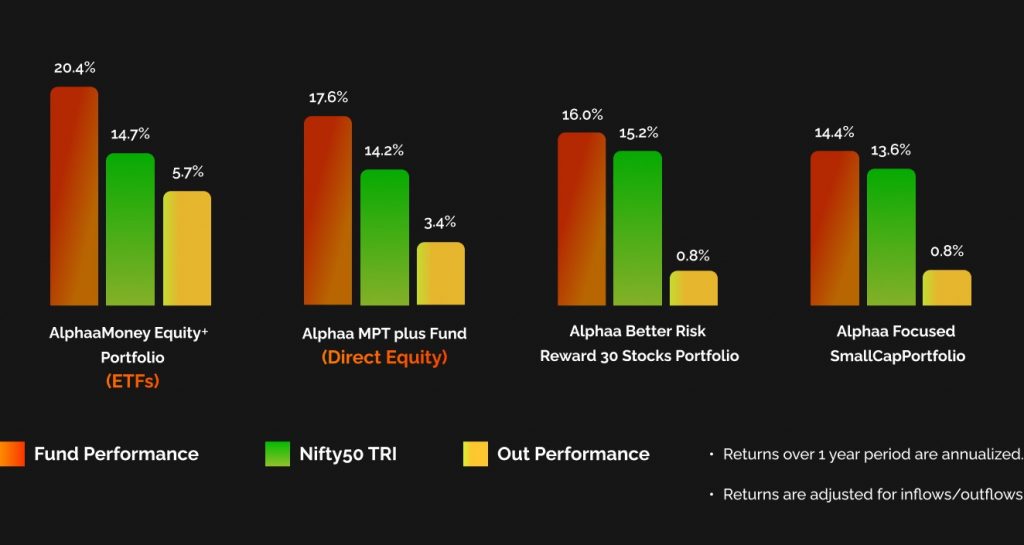

Alphaamoney PMS Portfolios have beaten the benchmark indices handsomely since its inception.

Performance of funds as on 31st December 25 ( Since Inception )

How Alphaamoney Makes Your Investments Smarter

Customized Strategies

Expert fund manager-led PMS services tailored to your risk profile, providing a personalized investment portfolio.

Fund Management Expertise

Benefit from the knowledge of experienced fund managers in creating and rebalancing your portfolio for optimal performance.

Diverse Investment Options

Choose from a range of strategies tailored to your goals, including small-cap funds, multi-cap equity funds and low-cost ETFs, providing balanced and diversified portfolios.

Clear Insights on Your

Investments

Stay updated with transparent performance tracking, so you always know how your investments are doing.

Flexible Options for Every

Investor

Choose from a range of solutions, whether you’re looking for a PMS starting at ₹50 lakhs or a mutual fund portfolio starting at ₹50,000 or lower.

Alphaamoney - For Investors

Investors with 50 Lakhs+

Alphaamoney PMS

Benchmark Beating PMS

Investors with 50 Lakhs

Automated ETF Portfolio

Algorithm-selected low-cost ETFs/Index funds

Mutual Fund Portfolio

Invest in benchmark-beating PMS, managed by experts to grow your wealth effectively.

Trustworthy and experienced fund managers. Backed by AlphaaMoney’s SEBI-registered parent company, with over ₹1.25 lakh crore in AUA, your investments are in safe, expert hands.

- For investors with ₹50 lakhs+ investment amount

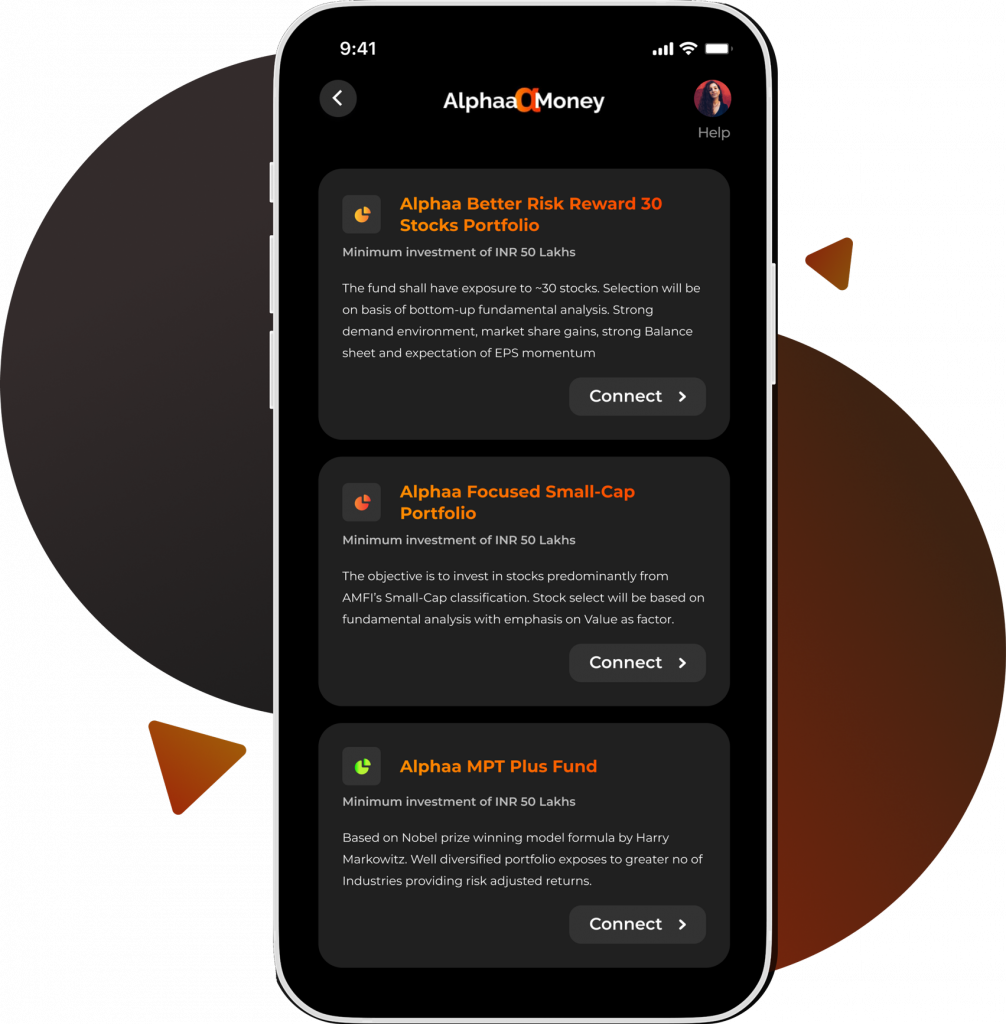

- 3 Direct Equity PMS strategies tailored to your risk profile

- Alphaa Better Risk Reward 30 Stocks Portfolio

- Alphaa Focused Small-Cap Portfolio

- Alphaa MPT Plus Fund

- Algo-driven low-cost ETF portfolio built on Modern Portfolio Theory (MPT)

- Alphaa Money Equity+ Portfolio

Create Personalized Mutual Fund Portfolio with the Assistance of an Experienced Fund Manager

Unlock the potential of your investments with tailored strategies designed to help you achieve your financial goals.

- For investors with ₹50000 +

- Assess your risk profile with a simple questionnaire

- Discuss goals with a relationship manager

- Build a customized mutual fund portfolio

- Rebalance regularly with fund manager’s guidance

Smart Automated Investments Using Algorithms Made by Fund Managers

Invest in ETFs with PMS designed using Modern Portfolio

Theory

-

Algorithm blends fund manager expertise &

advanced tech.

- Diversified across equities and precious metals.

- Optimized asset allocation using MPT

- Regular portfolio monitoring and rebalancing.

Control Your Investments

On-the-Go

Effortlessly manage your portfolio with

Alphaamoney. Access and manage your

investments from anywhere, anytime.

Get the App

Discover Your Investment Comfort Zone

Your investment comfort zone determines how you handle market fluctuations and helps us ensure a peaceful investment journey for you.

Meet Our Management Team

Puneet Pandey

MANAGING DIRECTOR

AUA handled

More than 3,00,000 crores

AUA Currently Handling-

More than 3,00,000 crores

Our dedicated founder and leader is known for his impeccable integrity and passion. With a profound understanding of financial products and over 31 years of extensive experience with global financial firms, he specialises in fixed income, treasury management, and corporate finance.

Puneet Pandey

MANAGING DIRECTOR

Key positions held –

Founder of PRPe, Senior Management positions at JM Financials, Morgan Stanley, Fortis Religare, Ashok Leyland Finance

Prakhar Pandey

EXECUTIVE DIRECTOR & CEO MANAGING PARTNER – EQUITY AND PMS

AUM handled

1200 Crs

AUM Currently Handling AUA-

5000 croress

Prakhar Pandey, a dynamic second-generation entrepreneur, vision is to establish a leading financial conglomerate, leveraging his international expertise from major financial hubs around the world. Prakhar’s deep insights into the financial landscapes of Singapore and London bring a fresh perspective to Alphaamoney, driving cross-national growth and innovation.

Prakhar Pandey

EXECUTIVE DIRECTOR & CEO MANAGING PARTNER – EQUITY AND PMS

Key positions held –

Senior Management Positions at PRPe, Moolaah, Finmoo, Prime Securities, Eastspring Investments (Singapore)

Jyoti Prakash

MANAGING PARTNER – EQUITY AND PMS

Key positions held-

Head of Equity at Aegon Life (now Bandhan Life Insurance)

AUM handled-

More than 2000 Crs

Currently our Lead Fund Manager at –

PRP Edge Wealth, PMS

Our senior most fund manager, Jyoti Prakash is a consistent performer with over 35 years of experience. The Hindu ranked one of the funds managed by him as the best-performing multi-cap fund. An avid reader and author, Jyoti brings a deep macro understanding of finance by following research from top universities and has a keen interest in behavioural finance

Jyoti Prakash

MANAGING PARTNER EQUITY AND PMS

Key positions held –

Head of Equity at Aegon Life (now Bandhan Life Insurance)

Paramjeet Singh

EXECUTIVE DIRECTOR & CEO MANAGING PARTNER – EQUITY AND PMS

Paramjeet Singh, with a Post-Graduate Diploma in Business Administration (PGDBA) specialising in Finance and alternate products, brings over 29 years of experience in MNC banks, Indian banks, and multi-family office wealth setups. He has held significant roles at Axis Bank, HDFC Bank, and BNP Paribas

Paramjeet Singh

PRESIDENT WEALTH AND PRODUCT

Key positions held –

Senior Vice President, BNP Paribas