Grow Your Wealth with Professional Portfolio Management Services

Invest in Alphaamoney benchmark-beating PMS

Why Alphaamoney PMS?

Higher Returns

Our PMS has consistently outperformed market indices, helping you grow your investments faster.

Performance of funds as on 31st December 2025 ( Since Inception )

- Returns over 1 year period are annualized.

- Returns are adjusted for inflows/outflows

AlphaaMoney Equity+ Portfolio (ETFs)

Fund Performance

20.4%

Nifty50 TRI

14.7%

Out Performance

5.7%

Alphaa MPT plus Fund (Direct Equity)

Fund Performance

17.6%

Nifty50 TRI

14.2%

Out Performance

3.4%

Alphaa Better Risk Reward 30 Stocks Portfolio

Fund Performance

16.0%

Nifty50 TRI

15.2%

Out Performance

0.8%

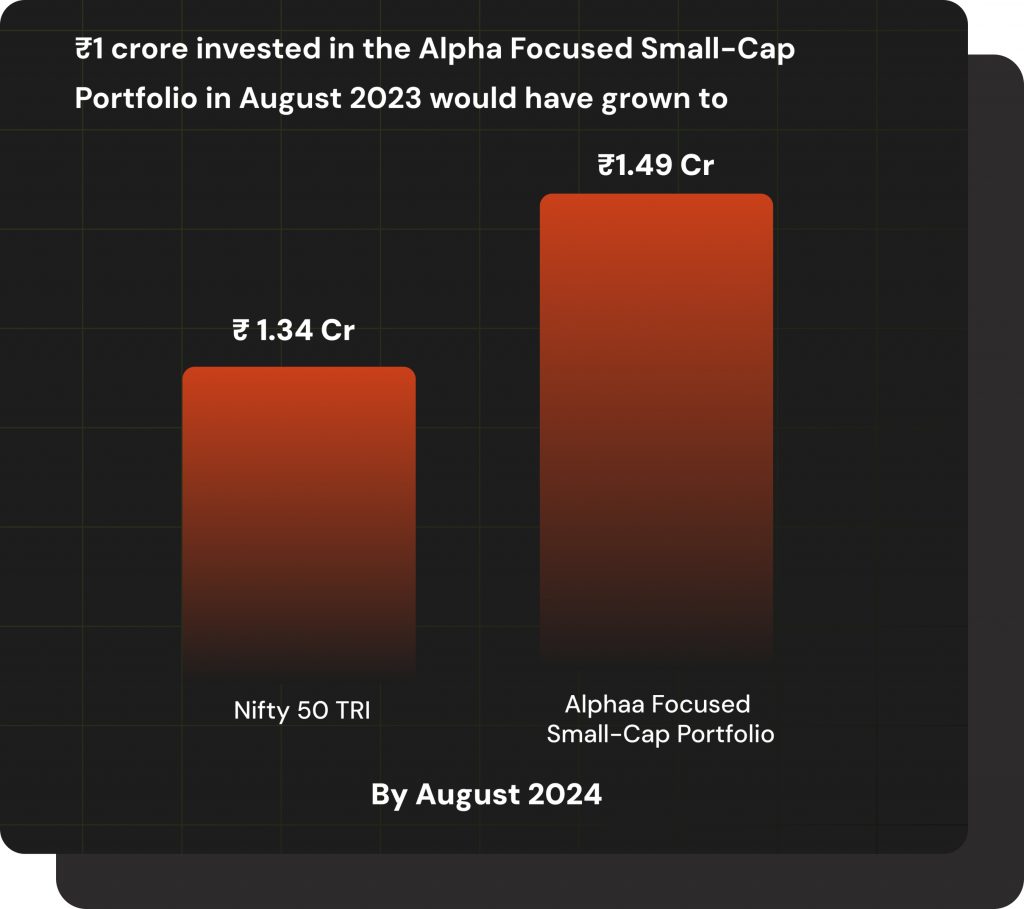

Alphaa Focused SmallCapPortfolio

Fund Performance

14.4%

Nifty50 TRI

13.6%

Out Performance

8.0%

Goal Oriented Investing

Whether you aim for aggressive growth or steady returns, we offer active and passive instruments portfolios aligned with your risk profile.

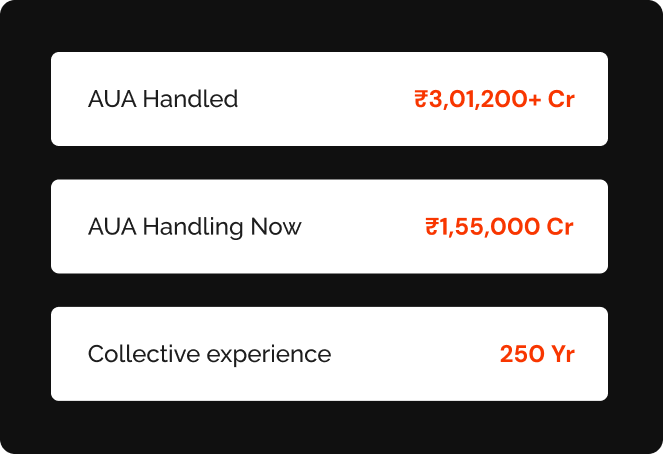

Experienced Fund Managers

With ₹1.55 lakh crores in Assets Under Advisory (AUA), our fund managers ensure your investments are expertly managed and in safe hands.

Timely Rebalancing

Regularly adjust your asset allocation and investments to stay aligned with your goals and manage risk effectively.

Your Wealth, Our Priority

Focus on living the life you love while we focus on maximizing your investments.

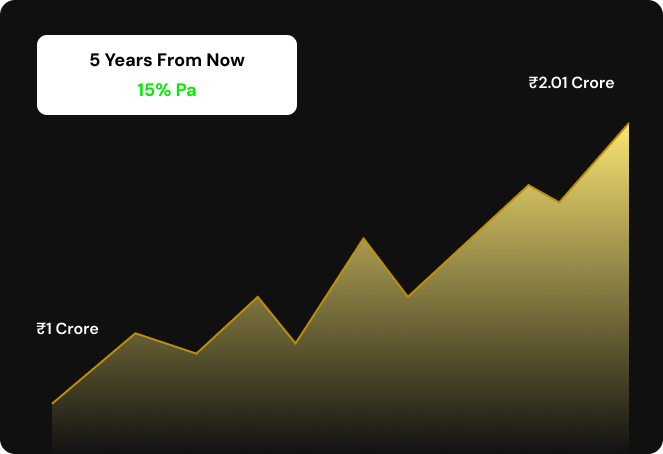

Assuming a compounded annual return of 15%. Please note that all return figures are hypothetical and intended for illustrative purposes only. These figures do not represent expected or estimated return rates.

Investment Procedure

AlphaaMoney PMS is Best For Investors

The minimum amount to invest in Portfolio Management Services in India is 50lakhs, making it suitable for.

Investors with long-term goals, such as retirement planning or wealth accumulation.

High-salaried busy professionals who lack the time for active investment management

Business owners and entrepreneurs with substantial capital to invest

Alphaamoney PMS Strategies

Discretionary PMS

Alphaa Better Risk Reward 30 stocks Portfolio:

Portfolio of fundamentally strong stocks, market cap agnostic

Alphaa Focused Small-Cap Portfolio:

Portfolio of fundamentally strong small cap stocks

Based on Modern Portfolio Theory (MPT)

Alphaa Money Equity+ Portfolio:

Portfolio of ETFs – Large Cap, Mid Cap, Factor-based, Sectoral & Gold, constructed using MPT

Alphaa MPT Plus Fund:

Portfolio of stocks with long track record and sound financials constructed using MPT

Fixed Income Fund

PRP Fixed Income Fund: Debt Instruments rating with BBB & above and money market instruments with rating A1 & above

Frequently Asked Questions

What is Portfolio Management Service (PMS)?

Portfolio Management Service (PMS) refers to a specialized financial service offered by professional fund managers who manage investments on behalf of clients. The primary objective is to optimize returns by creating a customized portfolio tailored to an investor’s specific financial goals, risk tolerance, and investment horizon.

Who regulates PMS in India?

In India, the Securities and Exchange Board of India (SEBI) regulates Portfolio Management Services (PMS). SEBI sets guidelines and norms that PMS providers must adhere to, ensuring transparency and protecting investors’ interests.

What is Modern Portfolio Theory (MPT)?

Modern Portfolio Theory (MPT), developed by American economist Harry Markowitz in 1952, is a framework for building a portfolio that maximizes expected return for a given level of risk. The theory emphasizes that an asset’s risk and return should be evaluated based on its contribution to the overall portfolio, rather than in isolation.

Are all Alphaamoney PMS created using MPT?

No, two of Alphaamoney’s PMS are built using Modern Portfolio Theory (MPT). These portfolios are actively managed by fund managers, combining the benefits of MPT’s algorithm with expert oversight to monitor and adjust the asset allocation periodically.

What are the benefits of PMS?

PMS offers several advantages, including:

- Personalized Investment Strategy: Tailored portfolios based on individual financial goals and risk profiles.

- Active Management: Continuous monitoring and adjustment of investments by professional fund managers.

- Transparency: Regular updates and reports on portfolio performance.

- Access to Expertise: Benefit from the knowledge and experience of seasoned investment professionals.

How are PMS different from mutual funds?

While both PMS and mutual funds are investment vehicles, they differ in several ways:

- Personalization: PMS delivers tailored investment strategies for individual goals, whereas mutual funds follow a uniform portfolio approach.

- Minimum Investment: PMS typically requires a higher minimum investment compared to mutual funds.

- Management Style: PMS usually offers active management, while mutual funds can be actively or passively managed.

Who should invest in PMS?

PMS is suitable for high-net-worth individuals (HNIs) and investors with a substantial capital base who seek personalized investment management and are comfortable with higher investment minimums. It’s ideal for those who want a tailored approach to investing and are looking for active portfolio management.

What is the minimum amount required for PMS in India?

As per SEBI regulations, the minimum investment required for Portfolio Management Services (PMS) in India is ₹50 lakh

Can NRIs invest in Portfolio Management Services (PMS) in India?

Yes, NRIs with an updated KYC and a demat account can invest in PMS in India through their NRE or NRO accounts.