Table of Contents

- What is Market Volatility?

- What Causes Market Volatility?

- How to Identify if the Market is Volatile

- Mistakes to Avoid During Market Volatility

- How to Navigate Market Volatility for Better Returns

- How Financial Advisors Can Help You Navigate Market Volatility?

- Invest in Benchmark-Beating AlphaaMoney PMS

Ever felt anxious watching your investments dip overnight? You’re not alone. Market volatility can make even confident investors second-guess their decisions.

It tests your patience, challenges your judgment, and shakes your long-term plans. But here’s the truth: market volatility is nothing new – and it’s something every investor can learn to manage.

Learning to navigate these fluctuations is essential to long-term investment success.

In this guide, we’ll break down the causes of market volatility and share practical strategies to help you stay calm, make informed decisions, and stay aligned with your financial goals during volatile markets.

What is Market Volatility?

Market volatility refers to frequent and significant price changes in financial markets, driven by factors such as economic indicators, global events, market sentiment, and investor behavior.

It is a measure of how much a security’s price fluctuates over time, often calculated using standard deviation or variance. Higher volatility means greater price swings, which can increase both risk and opportunity for potential returns.

In financial markets, volatility is marked by sharp price movements, both upward and downward. For example, when stock prices consistently rise or fall by more than 1% over a short period, the market is considered volatile.

What Causes Market Volatility?

Market volatility is influenced by multiple factors that affect investor confidence and market stability:

Economic Indicators

Key reports, like GDP growth, unemployment rates, and inflation, often set the stage for sudden market moves. When these reports come in better or worse than expected, markets can react quickly.

Interest Rate Changes

Central banks, like the Reserve Bank of India (RBI) or the U.S. Federal Reserve, play a big role here. Their decisions on interest rates can either stimulate or slow down the economy, influencing market trends.

For example, the combination of Russia-Ukraine war tensions, high inflation, and interest rate hikes in 2022 significantly impacted the markets. Inflation in India stayed above the RBI’s target range, peaking at 7.8% in April 2022, while globally, inflation hit a 41-year high of 9.1% in the US in June 2022.

Due to these global and domestic economic pressures, India witnessed a 9.07% drop in the Nifty 50 during the first half of 2022

Geopolitical Events

Significant events, such as elections, international conflicts, or trade tensions, can create uncertainty. This uncertainty often leads to increased market volatility as investors impulsively react during these situations.

The COVID-19 pandemic, which began in China in December 2019 and rapidly spread worldwide, significantly impacted the Indian stock market. On March 23, 2020, the Nifty 50 experienced a sharp decline of 12.98%, hitting its lowest level in four years.

Domestic Policy Changes

Government policies, such as budget announcements or changes in regulations, often shake things up. Investors weigh these decisions carefully, trying to gauge their potential impact on businesses and industries.

After the Union Budget 2024 was announced, Indian stock markets saw a significant drop due to the government’s proposal to raise taxes on capital gains and derivative trading. The NSE Nifty 50 and the S&P BSE Sensex initially plunged around 1.6% after Finance Minister Nirmala Sitharaman’s speech, reflecting investor concerns.

However, both indices managed to recover most of their losses by the end of the day, closing just 0.12% lower.

Along with these fluctuations, the Indian rupee fell to an all-time low against the US dollar, reaching 83.69 (At that time).

On a positive note, in 2019, the Indian government introduced major corporate tax reforms by slashing the base corporate tax rate from 30% to 22%.

Finance Minister Nirmala Sitharaman’s surprise announcement sparked a strong market reaction, leading to a 4.5% jump in the Sensex. The move was aimed at attracting global investments, boosting the competitiveness of the private sector, and creating more job opportunities.

Corporate Earnings Disappointments

When companies report earnings that fall short of expectations, it can lead to a significant drop in their stock prices. This, in turn, may trigger broader market reactions, especially if it’s a major player in the market.

Investor Psychology

Lastly, market volatility is often fueled by investor sentiment—fear can prompt widespread selling, while overconfidence can lead to market bubbles.

Market volatility is a natural part of investing. Although short-term fluctuations can be unsettling, historical data shows that markets tend to recover and grow over time.

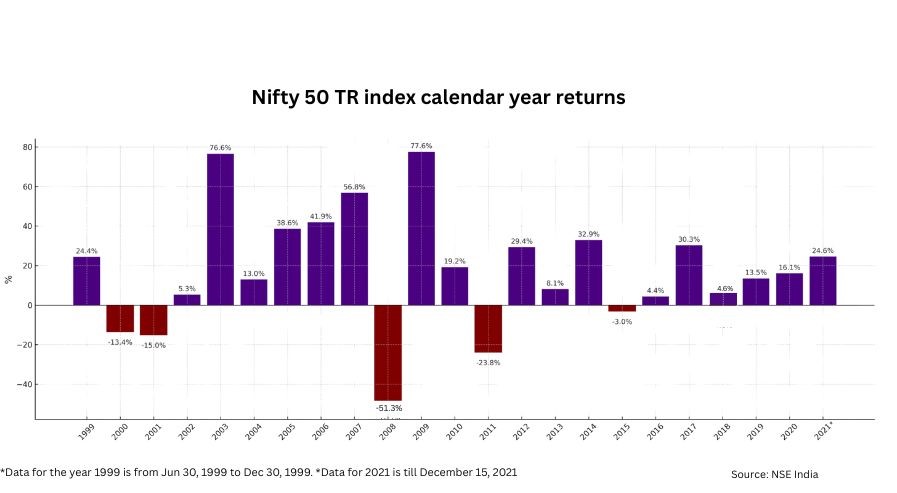

For example, in 2008, the market faced a massive crash with the Nifty 50 plummeting by -51.3%, but the following year saw a strong recovery, delivering a 77.6% return. (Source: NSE Archives 20 years of Nifty 50)

By studying past trends, investors can set realistic expectations, adopt sound strategies, and build portfolios that withstand market ups and downs.

Tracking domestic policies, interpreting global events, analyzing economic indicators, and staying updated on corporate performance—it’s a full-time job. For most investors, keeping up with this constant flow of information is not only overwhelming but can also lead to missed opportunities or emotional decisions that hurt long-term returns.

That’s why it’s better to seek expert help to manage your money.

For HNIs, Portfolio Management Services (PMS) offer a personalized, research-backed approach to build portfolios that manage risk and navigate volatility effectively.

For retail investors, it’s wise to consult a certified advisor or create a mutual fund portfolio tailored to their goals and risk profile with the help of an expert—so investors can invest with confidence, even during market volatility.

Below this you can mention how all these things like keeping track of domestic policy change, geopolitical events, etc could be a headache of investors as it requires knowledge and time. And thus why relying on expert through PMS services is a good solution to keep your loose less and gain more in volatile situations.

How to Identify if the Market is Volatile

- Trading volumes shoot up suddenly: A surge in the number of shares being bought and sold typically means more investor activity and uncertainty, often triggered by news or economic events.

- Price gaps appear: If many stocks or indices open much higher or lower than their previous closing prices, it shows increased buying or selling pressure overnight, a common sign of volatility.

- Sharp daily moves occur: For example, if a stock jumps from ₹100 to ₹110 in one day and then drops to ₹90 the next, it shows high price swings. But to confirm overall market volatility, such movements should be seen across many stocks or broader indices – not just in a single stock.

Important Metrics to Measure Volatility in the Stock Market

- India VIX (Volatility Index): A market sentiment indicator that estimates the expected volatility in the Indian stock market over the next 30 days, derived from Nifty options pricing. A higher VIX means more uncertainty and chances of sharp price changes.

- Beta: Measures how sensitive a stock is to broader market fluctuations.. A beta of 1 means it moves in line with the market. Above 1 shows higher movement, and below 1 means less.

- Standard Deviation: Indicates how much a stock’s price deviates from its average over a period. A higher value suggests more price fluctuations.

How Volatility Is Calculated?

Volatility is typically calculated using this formula:

Volatility (V) = Standard Deviation (σ) × √T

Where:

- V is the volatility over a chosen time period

- σ is the standard deviation of returns

- T is the number of time intervals (such as days or months)

Mistakes to Avoid During Market Volatility

Market volatility can be tough, even for seasoned investors. During times of uncertainty, emotions can cloud judgment, leading to costly mistakes. Here are some common mistakes you should avoid during volatile market phases.

Panic Selling

When the market declines, it’s natural to feel the urge to sell and cut your losses. However, panic-selling locks in those losses and can hurt long-term returns.

Going to Cash and Staying There

The temptation to pull out and go to cash during market declines can be costly. Investors who stay in cash miss out on the strong rebounds that typically follow downturns.

Overestimating Your Ability to Time the Market

Many investors think they can predict the bottom or top of the market, but this is often a mistake. Overconfident investors tend to hold onto losing stocks (in case of stock investing) in hopes they’ll recover or jump into declining ones thinking they’re bargains, ultimately making their portfolio more volatile.

Trying to Recover Losses by Making Riskier Moves

It’s common to try to “make up” for past losses by doubling down on riskier investments. However, this often leads to even greater losses, as it can encourage poor timing and emotional decisions.

Forgetting to Rebalance

During a market downturn, your portfolio’s asset allocation can shift significantly. Investors often neglect to rebalance their portfolios, which can delay recovery and expose them to more risk than initially intended.

How to Navigate Market Volatility for Better Returns

Market volatility can be daunting, but there are smart ways to handle it and still achieve strong returns. Let’s dive into some key strategies:

Maintain a Long-Term Perspective

Though market swings in the short term can be tempting to react to, staying aligned with your long-term goals is what truly drives meaningful investment success. When the market gets volatile, avoid making impulsive decisions.

By keeping your eyes on long-term growth, you’ll be better equipped to weather temporary turbulence and potentially reap the rewards as the market recovers.

For long-term goals, you can consider growth-oriented investments like stocks, equity mutual funds, or equity-oriented PMS. But if your goals are short-term, it’s wiser to stick with relatively stable instruments like low risk debt funds, fixed deposits, or short-term bonds.

Why Long Term Perspective Matters?

Take the Nifty 50 TRI from 1999 to 2021—returns ranged from a sharp fall of –51.3% in bad years to a rise of +77.6% in good ones.

Consider this: An investor who entered the market in 2007 saw a +56.8% return. But in 2008, the market crashed to –51.3%. If they panicked and exited, their losses would’ve been locked in.

But by staying invested, they’d have seen a rebound in 2009 with a +77.6% return, followed by +19.2% in 2010.

The takeaway? Adopting a long-term perspective helps even out market ups and downs over time. Even with occasional setbacks, staying the course can lead to strong average returns over time.

Diversification and Asset Allocation

Diversifying your investments is one of the most effective strategies to shield your portfolio from market ups and downs.

By spreading your investments across various asset classes, such as stocks, bonds, mutual funds and alternatives, you can minimize the risk of heavy exposure to any single investment.

Tailoring your asset allocation based on your risk tolerance and investment goals will help you build a more resilient portfolio that can better withstand the ups and downs of the market.

Here are three commonly followed asset allocation models.

- Conservative (Low Risk): Focuses on stability. Around 70–80% is placed in fixed-income options (like bonds and FDs), with 20–30% in low-risk equities such as blue-chip stocks. Ideal for short-term goals.

- Balanced (Moderate Risk): A 50-50 distribution between equities and fixed income instruments. Offers a middle ground between growth and stability, suited for medium-term goals.

- Growth (High Risk): Prioritizes long-term returns. Typically allocates 70–80% to equities, including growth stocks. Best for long-term investors with higher risk appetite.

If you prefer investing through mutual funds, there are options that come with pre-set allocations across different asset classes, designed to match various risk profiles.

However, there’s no one-size-fits-all strategy. These models serve as a starting point, but your asset mix should reflect your personal goals, time frame, and comfort with risk.

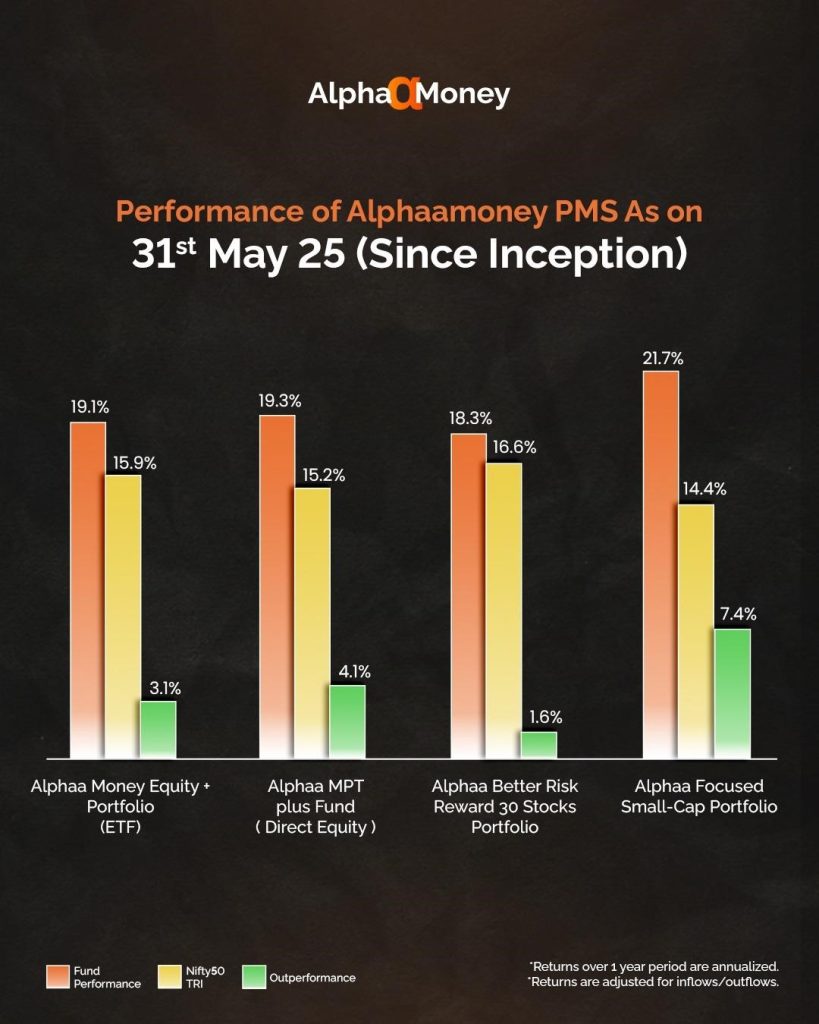

Professionally managed PMS strategies like AlphaaMoney, or even mutual fund portfolios, can be ideal for investors seeking to balance high-return potential with research-backed risk management, especially during volatile times.

For example, AlphaaMoney provides a variety of PMS options based on an investor’s specific needs and risk profile. These include the AlphaaMoney Equity+ Portfolio, which diversifies mainly across Indian stocks, foreign stocks, and gold; the AlphaaMoney Focused Small-Cap Portfolio, which focuses mainly on small caps; and a couple of other tailored options.

Investors can select the most suitable option that aligns with their goals and risk profile after gaining a clear understanding of the funds.

Review and Rebalance Your Portfolio

It’s important to check in on your portfolio regularly especially during periods of market volatility.

Take the time to assess how your investments are performing and whether any adjustments are needed. Rebalancing your portfolio to its target allocation ensures it aligns with your goals and risk preferences, helping to keep your strategy on track.

Stay Informed and Seek Professional Guidance

Staying informed about market trends and economic news is crucial for making sound investment choices because it helps you understand how various factors such as interest rates, inflation, or geopolitical events can affect different industries and asset classes.

However, for a more effective approach and better outcomes, consulting a financial advisor can be invaluable.

While strategies like diversification and regular portfolio reviews are helpful for navigating market volatility, there’s no one-size-fits-all approach. These strategies should always be tailored to your individual goals and risk profile.

Working with a financial advisor helps tailor your investment strategies to match your individual goals and circumstances. They will help craft personalized plans that not only navigate market volatility but also keep your investments aligned with your long-term financial goals.

How Financial Advisors Can Help You Navigate Market Volatility?

A Real-World Example of How Expert Guidance Made a Difference

Take the Indian stock market, for example, which experienced significant volatility earlier this year. Both the BSE Sensex and Nifty50 were on a steep downward slope for several sessions. Over nine consecutive negative sessions (as of Feb 17, 2025), the Sensex dropped by 3,000 points, shaking investor portfolios. Retail investors, especially in small-cap and microcap segments, felt the most pain, with bigger losses in these areas. To make matters worse, foreign institutional investors (FIIs) had pulled out Rs 1.12 lakh crore from Indian markets in the first two months of 2025, signalling caution due to the challenging global investment environment, particularly for emerging markets like India. But even in such challenging times, the right financial advice and portfolio management can make all the difference. Expert fund managers, with their in-depth knowledge and strategies, can help mitigate risks and seize opportunities, even during market downturns. Take AlphaaMoney’s Alphaa MPT Plus Fund (PMS), for example. In January 2025, it was ranked No.1 in the Flexi Cap category by PMSBAZAAR. Despite the NSE 500 Index declining by 3.55%, the NAV of the Alphaa MPT Plus Fund increased by 0.01%, demonstrating its resilience and superior performance even when the markets were falling.Invest in Benchmark-Beating AlphaaMoney PMS

Navigating market volatility can be overwhelming, but with the right guidance, you can invest smarter and ride out the ups and downs. AlphaaMoney’s PMS strategies, including the Alphaa MPT Plus Fund, have consistently outperformed benchmarks, even during tough market phases.

It’s not just past returns that make AlphaaMoney a go-to option. It’s als the proven expertise and research-driven approach:

- Fund managers with 35+ years of individual experience

- Portfolios built using Nobel Prize-winning Modern Portfolio Theory

- 250+ years of cumulative team experience

While PMS is traditionally for HNIs, AlphaaMoney also offers expert-managed mutual fund portfolios for retail investors, bringing the same strategic thinking and market insights to all.