How to invest in PMS in India? Everything You Need to Know

Table of Contents

- What is PMS?

- Who can Invest in PMS in India?

- How to Invest in PMS in India? Step-by-Step Process

- Documents Required to Open a PMS Account in India

- What Are the Different Charges for PMS in India?

- What to Do If You Have a Complaint About Your PMS Provider?

- Invest in Alphaamoney Benchmark Beating PMS

Managing substantial wealth requires strategies that go beyond standard investment options. That’s where Portfolio Management Services (PMS) come in, offering a personalized and professional way to grow your investments.

Whether your goal is steady wealth accumulation or portfolio diversification, PMS provides expert management tailored to meet your unique needs.

This guide offers a detailed explanation of investing in PMS, covering the basics, eligibility criteria, step-by-step process, associated fees, and required documents before beginning your PMS investment journey.

If you’re already familiar with PMS and want to jump straight to the steps, head over to the section titled “How to Invest in PMS in India – Step by Step Process.”

What is PMS?

Portfolio Management Services (PMS) is a highly customized investment solution designed for individuals with significant wealth. It’s a step up from traditional investment methods, offering a tailored approach to managing your portfolio in line with your financial goals, risk appetite, and preferences.

In PMS, a dedicated portfolio manager is assigned to manage your investments, making informed decisions tailored to your financial goals. The fund manager may guide you on strategically allocating your portfolio across various asset classes such as equities, fixed income, and other securities.

Unlike mutual funds, where your money is pooled with others, PMS ensures that investments are made directly in your name, offering greater transparency and allowing you to stay closely involved with your portfolio’s performance.

PMS stands out for its personalized nature, making it an excellent choice for high-net-worth individuals (HNIs) and ultra-high-net-worth individuals (UHNIs) who are looking for tailored strategies to grow and safeguard their wealth.

Portfolio Management Services (PMS) are primarily designed for investors who meet certain eligibility criteria and are looking for professional expertise to manage and grow their wealth. The following individuals and entities are eligible to invest in PMS:

- Resident Indians: Citizens living in India who wish to manage their investments with expert guidance.

- Non-Resident Indians (NRIs): Indians living abroad who want to grow and manage their investments from overseas.

- Persons of Indian Origin (PIOs)nationals of Pakistan, Afghanistan, Bangladesh, China, Iran, Bhutan, Sri Lanka, and Nepal) who meet any of the following criteria:

-Have previously held an Indian passport, or

-Are descendants of individuals whose parents, grandparents, or great-grandparents were born and permanently residing in India (as defined in the Government of India Act, 1935) or in territories that later became part of India, provided neither was ever a citizen of the above-mentioned countries.

-Spouses of Indian citizens or PIOs.

- Institutional Investors: Banks, corporations, partnership firms, and Hindu Undivided Families (HUFs) can also invest.

- Minimum Investment: To get started with PMS, the minimum investment required is INR 50 lakhs, making it a suitable option for high-net-worth individuals (HNIs) and ultra-high net worth individuals (UHNIs).

If you meet any of these criteria, you’re all set to explore the world of PMS and elevate your investment strategy in India.

Investing in Portfolio Management Services (PMS) might appear complex initially, but understanding the process can make it straightforward and rewarding.

By following a structured approach, you can make informed decisions, stay compliant with regulations, and avoid common mistakes. Here are the steps to help you navigate the process safely and confidently:

1.Research and Compare Providers

Start by identifying reputable PMS providers. Evaluate their track record, investment philosophy, and historical performance. It’s also important to review the experience and history of the fund manager.

2.Verify the Registration Details of the Portfolio Manager

Before proceeding, it’s crucial to verify the registration details of the portfolio manager. Visit the SEBI website (www.sebi.gov.in) to check the regulations, circulars, and the list of registered portfolio managers. Make sure the portfolio manager is registered with SEBI, and find their contact details and address on the SEBI list to confirm their authenticity.

3.Understand the Fee Structure: Ensure you have a clear understanding of the type of PMS you’re opting for, along with its fee structure. Being informed about the costs upfront will help you set realistic expectations and avoid any confusion later on.

4. Select the Right PMS Provider for You: Pick a PMS provider that matches your investment goals, risk appetite, and personal preferences. A good fit will enhance your investment experience and ensure alignment with your financial objectives. Make sure you’ve read and understand the terms and conditions in the disclosure document provided by the PMS provider before entering into the agreement.

5. Discuss Your Financial Goals and Risk Appetite: Communicate your financial objectives and risk tolerance with your portfolio manager. Ensure the investment strategy aligns with your goals, whether it’s wealth creation, income generation, or capital preservation.

When investing in PMS, you’ll need to open a separate Demat account to hold your securities and a bank account for receiving gains or dividends. These accounts will be under your name, but you’ll grant a power of attorney to the portfolio manager, allowing them to manage the accounts on your behalf. However, you will retain full access to monitor your investments.

7. Complete Documentation: Provide all necessary KYC and other required documents, and sign an agreement outlining the terms of service, investment objectives, and risk profile.

8.Fund the Account: Transfer the initial investment amount to your PMS account. Ensure timely transfers to avoid delays in deployment.

9. Monitor Performance: Keep track of your investment’s progress by regularly reviewing the performance reports and updates provided by the portfolio manager. This will help ensure that your portfolio stays aligned with your financial goals and allow you to make informed decisions if adjustments are needed.

When opening a PMS account as an individual investor in India, you will need to provide the following documents:

- PAN Card: Mandatory document for tax-related purposes.

- Photographs: Passport-sized photos for identity verification.

- Address Proof: An Aadhar card is typically used for address verification.

- Guardian’s PAN and Aadhar: If the nominee is a minor, their guardian’s PAN and Aadhar card are needed.

- Second Holder Documents: If there’s a second holder on the account, their PAN and Aadhar card copies are also required.

- Bank Proof: Submit any of the following:

-A pre-printed cancelled cheque in the account holder’s name.

-Bank statement or passbook.

-If the cancelled cheque is in the name of a proprietary firm, a bank letter with a bank stamp is necessary.

- FATCA Declaration: A compliance form to meet Foreign Account Tax Compliance Act (FATCA) requirements.

- Copy of Power of Attorney (POA): A signed document granting the portfolio manager authority to manage your accounts on your behalf.

- Demat Account Opening Form: For opening a Demat account.

- Term Sheet: A document outlining the key terms and conditions of your PMS account.

When investing in a Portfolio Management Service (PMS) in India, you may encounter the following charges:

- Management Fees: PMS providers charge management fees for their services, and these fees are typically classified into three main types.

-Fixed Fees: These are recurring quarterly fees for managing your portfolio, typically ranging between 1% and 3% of your portfolio value, depending on the PMS provider.

–Performance-Sharing Fees: Under this model, the portfolio manager’s fee is linked to the performance of your portfolio. You only pay a fee if your portfolio exceeds a pre-set hurdle rate, which represents the minimum acceptable return that has been agreed upon.

–Hybrid Fees: This fee structure combines both fixed and performance-sharing fees. You’ll pay a fixed fee (similar to the fixed fee model) along with a performance-based fee if your portfolio exceeds the agreed-upon hurdle rate. - PMS Exit Load: An exit load of 1-3% is charged if you choose to exit your PMS investment before the agreed holding period, usually within 1-3 years. The fee is designed to encourage long-term investment and discourage premature withdrawals.

- Additional Charges: PMS providers may levy other fees, including:

- Custodian Fees

- Demat Account Opening Charges

- Audit Fees

- Transaction Brokerage

Since charges can differ between providers, it’s important to carefully review and understand the fee structure before committing to an investment in a PMS.

What to Do if You Have A Complaint About Your PMS Provider ?

You’ve understood how to invest in PMS in India, but what if you face problems with your PMS provider?

If you have any complaints regarding your PMS provider’s service, the disclosure document provided by your portfolio manager includes the contact details—name, address, and telephone number—of the investor relations officer responsible for handling such queries.

The document also outlines the grievance redressal and dispute resolution process.

Upon receiving complaints, SEBI will take the matter up with the concerned portfolio manager and follow up to ensure the issue is addressed.

Investors can send their complaints to:

Office of Investor Assistance and Education

Securities and Exchange Board of India (SEBI)

SEBI Bhavan

Plot No. C4-A, ‘G’ Block,

Bandra-Kurla Complex, Bandra (E),

Mumbai – 400 051

Invest in Alphaamoney Benchmark Beating PMS & Reach Your Financial Milestones with Confidence

Investing in Portfolio Management Services is not just about chasing returns—it’s about aligning your investments with your financial goals and trusting the expertise of seasoned professionals.

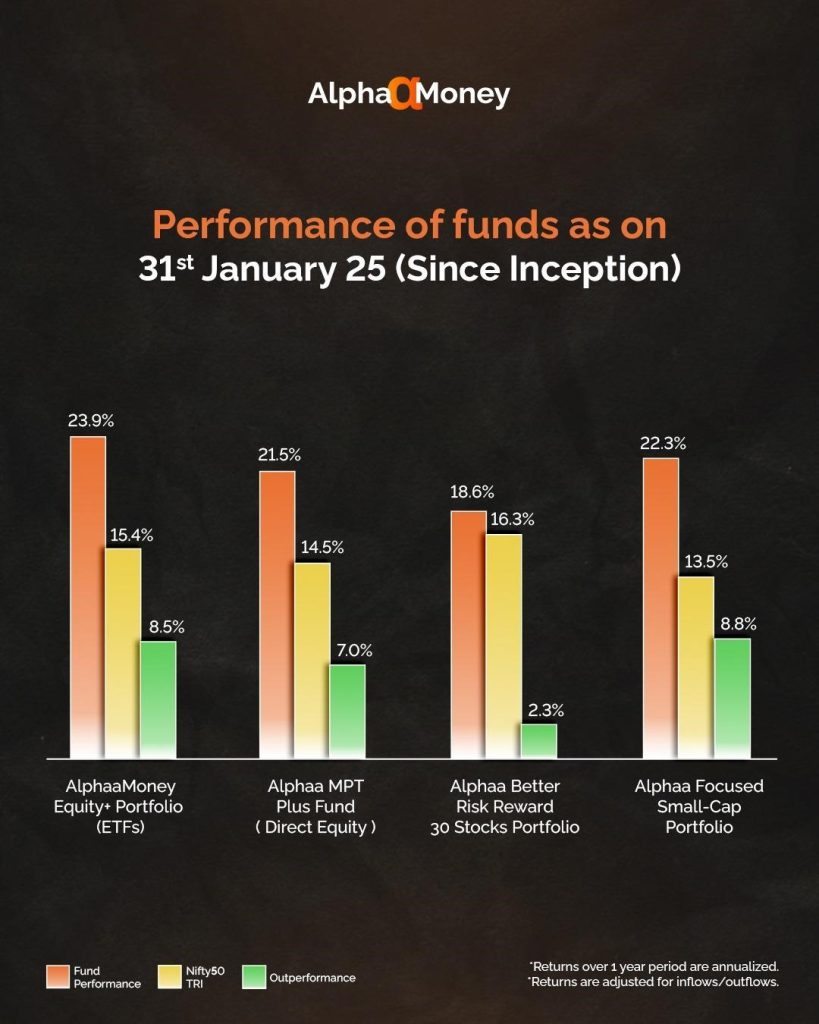

Alphaamoney PMS has consistently shown its ability to meet expectations and deliver solid performance.

Led by the experienced fund manager Jyoti Prakash, who brings over 35 years of industry knowledge and a history of managing top-rated funds.

His funds have consistently achieved 5-star ratings from Morningstar for 3-year, 5-year, and overall performance metrics, reflecting his proven track record in delivering exceptional results.

Notably, The Hindu ranked one of his mid-cap funds as the best in its category. His experience and insights into managing portfolios give Alphaamoney PMS an unparalleled understanding of market dynamics, consistently delivering strong results.

Beyond benchmark-beating performance, Alphaamoney offers personalized portfolio management that aligns with your unique financial goals and risk tolerance.

If you’re seeking a PMS provider that crafts portfolios aligned with your risk tolerance and financial objectives, while consistently outperforming market indices, Alphaamoney PMS could be the ideal partner to guide you on your investment journey with confidence.

Take control of your financial future today! Sign up with Alphaamoney PMS and invest in personalized strategies that are designed to help you reach your goals and turn your financial dreams into reality.