Grow your Wealth with Professional Portfolio Management Services

Invest in AlphaaMoney benchmark-beating PMS

Why AlphaaMoney PMS

Higher Returns

Our PMS has consistently outperformed market indices, helping you grow your investments faster.

Performance of Funds as on 30th September 2025 ( Since Inception )

- Returns Over 1 Year Period Are annualized

- Returns Over 1 Year Period Are annualized

AlphaaMoney Equity* Portfolio(ETFs)

Fund Performance

19.7%

Nifty50 TRI

13.1%

Out Performance

6.6%

Alphaa MPT plus Fund

(Direct Equity)

Fund Performance

18%

Nifty50 TRI

12.6%

Out Performance

5.4%

Alphaa Better Risk Reward

30 Stocks Portfolio

Fund Performance

15.5%

Nifty50 TRI

13.8%

Out Performance

1.7%

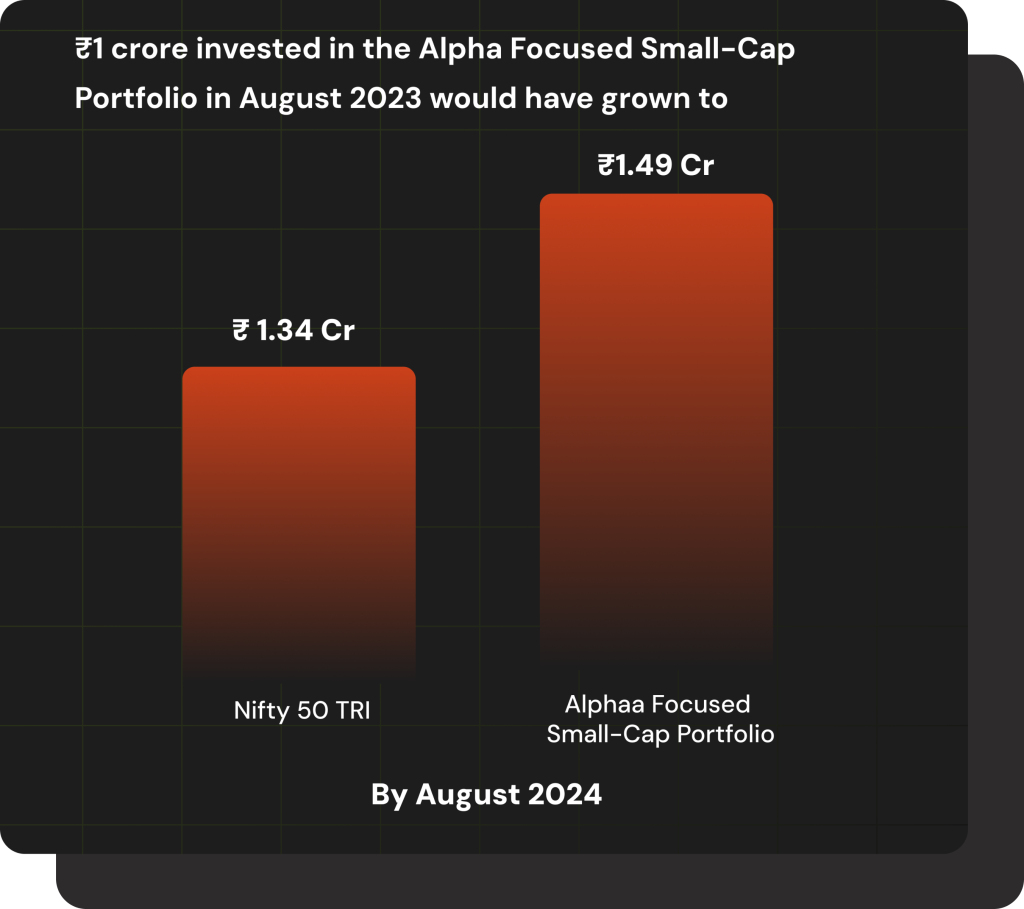

Alphaa Focused SmallCapPortfolio

Fund Performance

17.4%

Nifty50 TRI

12.0%

Out Performance

5.4%

Goal Oriented Investing

Whether you aim for aggressive growth or steady returns, we offer active and passive instruments portfolios aligned with your risk profile.

Experienced Fund Managers

With ₹1.55 lakh crores in Assets Under Advisory (AUA), our fund managers ensure your investments are expertly managed and in safe hands.

AUA Handled

₹3,01,200+Cr

AUA Handling Now

₹1,55,000 Cr

Collective experience

250 Yr

Timely Rebalancing

Regularly adjust your asset allocation and investments to stay aligned with your goals and manage risk effectively.

Periodic Rebalancing

Optimized Strategy

Risk Management.

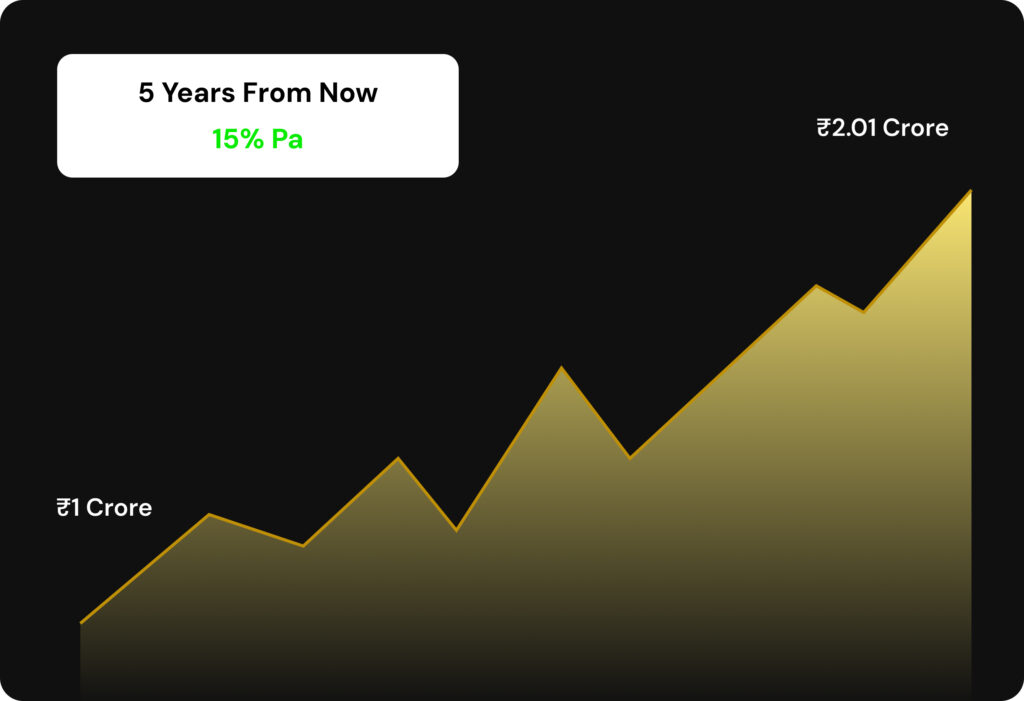

Your Wealth, Our Priority

Focus on living the life you love while we focus on maximizing your investments.

Assuming a compounded annual return of 15%. Please note that all return figures are hypothetical and intended for illustrative purposes only. These figures do not represent expected or estimated return rates.

Investment Procedure

AlphaaMoney PMS is Best For Investors

The minimum amount to invest in Portfolio Management Services in India is 50lakhs, making it suitable for.

Investors with long-term goals, such as retirement planning or wealth accumulation.

High-salaried busy professionals who lack the time for active investment management

Receive expert insights and tailored investment suggestions.

AlphaaMoney PMS Strategies

Discretionary PMS

Alphaa Better Risk Reward 30 stocks Portfolio:

Portfolio of fundamentally strong stocks, market cap agnostic

Alphaa Focused Small-Cap Portfolio:

Portfolio of fundamentally strong small cap stocks

Based on Modern

Portfolio Theory (MPT)

AlphaaMoney Equity+ Portfolio:

.

Portfolio of ETFs - Large Cap, Mid Cap, Factor-based, Sectoral & Gold, constructed using MPT

Alphaa MPT Plus Fund:

Portfolio of stocks with long track record and sound financials constructed using MPT

Fixed Income Fund

PRP Fixed Income Fund:

Debt Instruments rating with BBB & above and money market instruments with rating A1 & above

Frequently Asked Questions

Mutual funds pool money from multiple investors to invest in a common portfolio, while Portfolio Management Services (PMS) create a customised portfolio for each investor.

In a PMS, the stocks or securities are bought in your own demat account, giving you direct ownership. In contrast, mutual fund investors receive units of the fund instead of owning the underlying assets directly.

As per SEBI regulations, the minimum investment in PMS is ₹50 lakhs. In comparison, mutual funds allow you to start with as little as ₹100 via SIP or ₹1,000 lump sum, depending on the scheme.

PMS has the potential to deliver higher returns due to customised strategies, concentrated portfolios, and active management. However, higher returns are not guaranteed and often come with higher risk. Mutual funds offer more stable, diversified returns aligned with the scheme’s objective.

PMS typically charges 1–2% management fees plus performance fees of 10–20% of profits, along with transaction costs and possible exit loads. Mutual funds charge an expense ratio of around 0.5–2%, with lower exit loads and no performance fee.

Mutual funds generally offer better tax efficiency because transactions within the fund do not trigger tax events for investors until redemption. In PMS, every transaction in your account can have immediate tax implications.

Mutual fund portfolios are the same for all investors in a scheme, so you cannot customise holdings. PMS allows full customisation, letting you include or exclude specific stocks, sectors, or strategies based on your preferences.

PMS is ideal for High Net Worth Individuals (HNIs) with ₹50 lakhs or more who want personalised strategies, direct ownership of securities, higher return potential, and close interaction with a portfolio manager.